Bidders for Virgin Australia have outlined their plans, ASX had a big day for Jun 16 and recovery in the job market starts to occur.

Metals X has provided an update of Mineral Resources and Ore Reserves for the Renison Tin Operation, which it holds a 50% stake. An annual update has provided a Total Renison Proved & Probable Ore Reserve of 8.61 Mt at 1.40% Sn for 120,300 tonnes of contained tin. Mike Spreadborough CEO of Metals X indicated its been another good year post some significant exploration “Renison is a world class tin deposit and Australia’s largest primary tin producer. The results from the 2020 Mineral Resource and Ore Reserve update represent yet another outstanding year for the operation and will support a mine life in excess of 10 years. After our significant exploration success during 2018 and 2019, I am excited to report a maiden Ore Reserve for Area 5 hosting some 61,900 tonnes of contained tin at a grade of 1.87% Sn, with further resources still available at depth. As we ramp-up production in this area we will see the expected increase in mined tin grades flowing through the operation”.

Bombora has proven to be a very fruitful project for Breaker Resources. Several new high grade lodes have been discovered from deeper drilling at the Lake Roe project east of Kalgoorlie. Four drill holes produced significant gold mineralisation with visible gold, including 4.6m @ 12.5g/t Au including 1.3m @ 42.7g/t within a broader zone of 19.6m @ 3.13g/t. These results highlight the potential for growth at depth for Bombora. Breaker Resources Executive Chairman Tom Sander said “The success we have achieved through the recent shallow discovery 3km to the north, and now directly below the northern part of the 1Moz Bombora open pit Resource, shows the multiple options we have to grow the project – something that differentiates it from many of its peers. The new drilling has confirmed a 2km strike length of high-grade gold mineralisation situated directly below an extensively de-risked open pit Resource, 80% of which is in the Indicated category. The results highlight strong potential for a significant increase in the Resource at grades typically amenable to underground mining”.

White Cliff Minerals has completed a full data review of its Midas Cu-Au Projects. The review of Table Top and Coolbro Creek has identified 21 targets for further review. White Cliff have recently named the projects Midas and continues to investigate the area according to Technical Director, Edward Mead “The more work we do on the project, the more opportunities we see for potential structural fluid pathways, and geological units that have potential as traps for mineralised fluids. White Cliff needs to get on the ground and the recent rain that has delayed the geochemical sampling program is frustrating. The Company was aiming to utilise a crew already in the area as a way of minimising the costs of the program. “The Patersons Province has seen a lot of activity over the last 12 to 24 months, including the great success of Greatland Gold/Newcrest Mining at Haverion”.

CarSales has given a market update and shows an improvement since April 22 – June 16 on lead and traffic volumes. The total inventory of Carsales.com has decreased based on a significant reduction in time to sell due to increased demand from car buyers following the easing of social distancing restrictions. Also dealers have been facing challenges obtaining used and new car stock in the current environment and carsales research indicating an increase in first-time car buyers and people adding an additional car to their household as consumers look to avoid public transport. A total support package provided to dealers in FY20 will be approximately $26m.

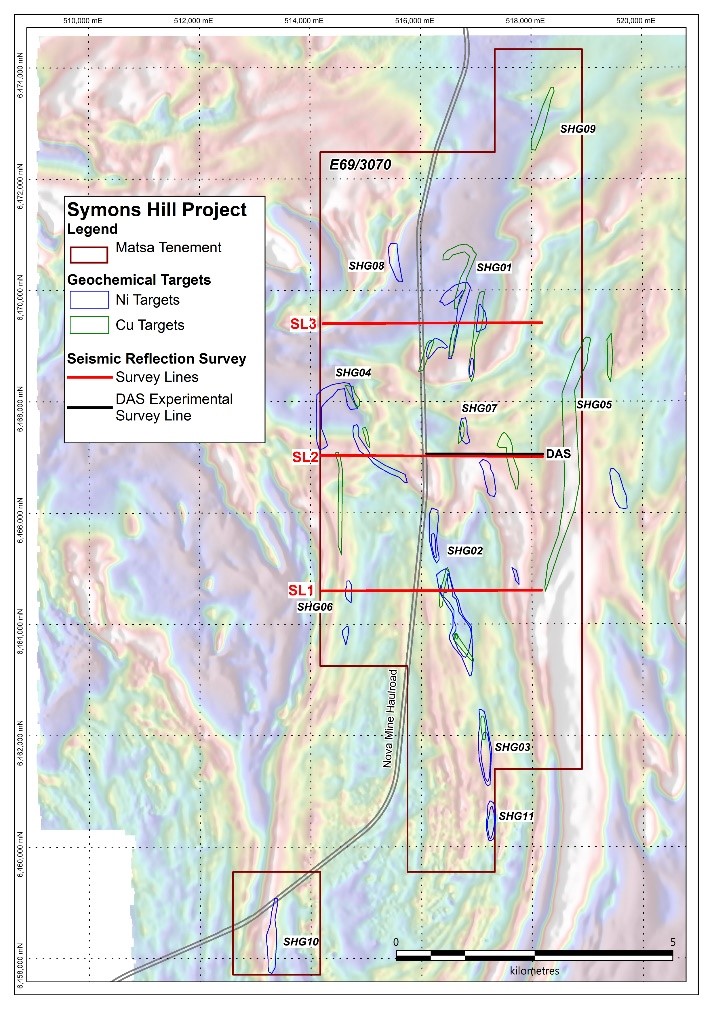

Independence Group subsidiary IGO Newsearch Pty Ltd, has taken an opportunity to enter a 70% interest in Matsa Resources Symons Hill at Fraser Range. The deal worth around $7 million in total is set to take place over a three year period. Symons Hill is approximately 70sqkm in area, with the Nova haul road running directly through the project. Matsa has completed exploration work and identified mineralisation in the area. Executive Chairman at Matsa Paul Poli said the focus of Matsa wasn’t Symons Hill recently, but maintained it was of value “The Symons Hill nickel project has been on the backburner for some time with Matsa’s focus on the Lake Carey gold project, but we always maintained it held considerable value. To partner with someone of IGO’s calibre demonstrates that value. I look forward to IGO using their vast knowledge and experience to exploit Symons Hill, while allowing Matsa shareholders to keep an exposure by retaining a 30% joint venture interest. It’s worth noting that Matsa controls some 170sqkm in its own right within the Fraser Range that is also of high value.