New financial year is HERE! A glimmer of hope after a horrid 6 months for world markets.

- AMP has sold its Life Insurance business to Resolution life for $3 billion. Broken down that figure is $2.5 billion cash; and $500 million equity interest in Resolution Life Australia, a new Australian-domiciled, Resolution Life-controlled holding company that is now the owner of AMP Life. AMP Chief Executive Francesco De Ferrari said “The sale is a major milestone for AMP demonstrating our ability to execute complex projects including through the difficulties of COVID-19. “It is also a historic moment as AMP ceases to be a life insurer after 170 years. Our Life teams will move to Resolution Life and will continue to support clients who will see no changes in their policy terms or conditions.”

- Chevron has completed its acquisition of Puma Energy via all shares and equity interests of Puma Energy. As part of this deal, 46 sites in the APN Convenience Retail REIT (AQR or the Fund) portfolio, representing 58% of AQR’s rental income are affected. Chris Brockett, APN Convenience Retail REIT Fund Manager, said: “The portfolio continues to be resilient, notwithstanding the COVID-19 pandemic, with all sites remaining open and trading and with minimal impact on rental income. The property valuation updates are a strong endorsement of the portfolio and reflect the enhanced credit quality of a Chevron lease covenant for 46 of our properties.” “We expect service station and convenience retail properties to remain highly sought after as a stable and defensive asset class due to their long leases and strong lease covenants.”

- The key results of the Definitive Feasibility Study for BCI Minerals for its 100% owned Mardie Salt and Potash project have been announced. A positive business case established for production of 4.4Mtpa of high purity salt and 120ktpa of premium SOP fertiliser. There was a Direct capital cost estimate of $580M for all production and port infrastructure. Additional capital cost provision for detailed design, owner’s costs, project management, growth allowances and contingencies of $199M, resulting in total capital cost of $779M. Additional working capital and funding costs are expected to be incurred during construction. According to Managing Director Alwyn Vorster “The DFS delivered positive outcomes in all key project areas and indicates Mardie is technically robust and financially attractive with a potential net present value of more than one billion dollars. An investment of $20M has been made over the past 18 months to deliver the high quality DFS and we will continue to derisk and add value to the Project over the next few months. This should further increase lender and investor confidence, supporting funding solutions.”

- A drill program has been finalised for Castillo Copper for its Mt Oxide pillar in Queensland. All of the appropriate approvals from the Queensland government has been attained and a up to 12 drilling contractors have been contacted regarding the project with priority given to a crew that is available on short notice at competitive rates. The program is expected to take around 6 – 8 weeks. As part of the proposed program around 3,432m over 14 drill-holes, within an area approx 1,500m by 1,000m, with targets near surface and deeper geophysical anomalies has been identified. Three deep vertical drill-holes, spaced approx 210m apart, will target an interpreted potential massive sulphide bedrock conductor.

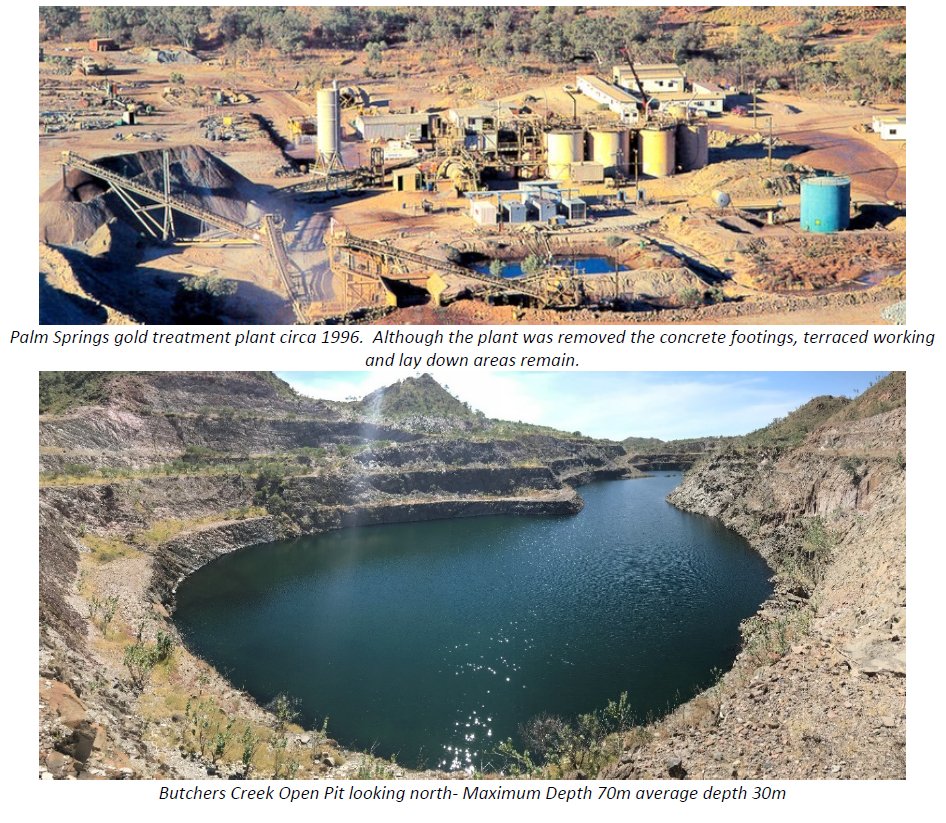

- Meteoric Resources has announced it has completed its acquisition of the Palm Springs gold project south east of Halls creek in the WA Kimberly region. The Palm Springs project contains 60 known gold occurrences over a 20km strike. Previous drill results have heralded 68m @ 2.5g/t Au from 44m and 19m @ 8.8 g/t Au from 56m. An extensive drill program for an area known as Butchers Creek Open Pit gold mine has been submitted to DMIRS with the expected start date to be August 2020. Managing Director Dr Andrew Tunks said “With this acquisition Meteoric is hopeful of producing some stunning exploration results throughout 2020. Previous work on the Palm Springs Project indicates the potential for a substantial untested gold system plunging south, away from the Butchers Creek historic mine yet there has been no active exploration in the Butchers Creek area this century!”